By Michael R. Bright | 8/29/2018

|

|---|

|

The U.S. mortgage market today largely relies on the secondary market to provide the capital necessary to help make affordable homeownership possible. I’m proud to say that Ginnie Mae’s role in the delivery of capital for homeownership has never been greater. As the organization approaches $2 trillion in outstanding mortgage-backed securities (MBS), we’re focused on meeting the needs of our current investors and tapping into new markets in the U.S. and around the world to help maintain the flow of low-cost capital. The capital markets are extremely dynamic. Ginnie Mae has committed to matching that dynamism on behalf of the hundreds of thousands of homeowners we help every year.

MBS Ownership

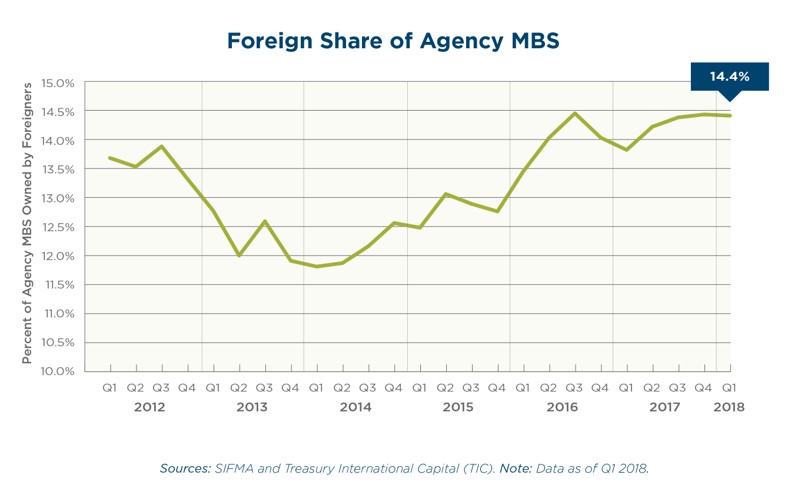

Foreign investors held 14.4 percent of agency MBS in Q1 2018, up sharply from the lows in 2013. For the month of March 2018, this represents $920.7 billion in Agency MBS; $405.2 billion held by foreign official institutions and $515.5 billion held by foreign private investors.

|

Meet the Executive

|

|