| 6/26/2025 | | WASHINGTON, D.C. – Ginnie Mae today released its latest Capital Markets Live podcast, which examines the relationship between the strength of the Federal Housing Administration’s Mutual Mortgage Insurance (MMI) fund and Ginnie Mae Mortgage Backed Securities (MBS) based on the latest annual report released by FHA in November 2021.

Ginnie Mae Managing Director of International Markets, Alven Lam is joined on the podcast by Stephen Abrahams, Senior Managing Director and Head of Investment Strategy at Amherst Pierpont Securities. The Ginnie Mae Capital Markets Live podcast can be heard here. The full report on the FHA MMI fund can be found here. About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|

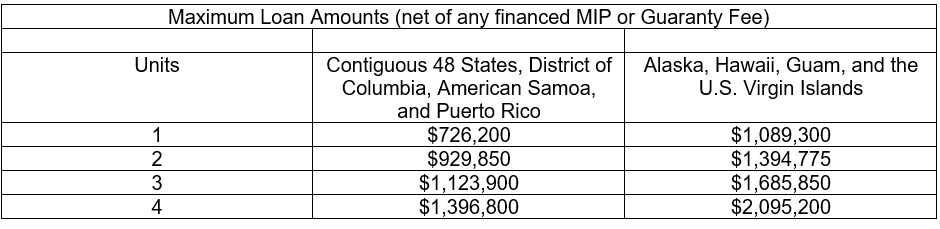

| 12/22/2022 | | WASHINGTON – Ginnie Mae today announced new loan limits for calendar year 2023 for single-family forward mortgages eligible for pooling in its mortgage-backed securities programs. Loan limits for most of the country will increase in the coming year due to house price appreciation during the first half of 2022, which is factored into the statutorily mandated calculations used to determine the limits each year. Additional details regarding the new loan limits can be found in APM 22-14. The new mortgage loan limits are effective after January 1, 2023:

Keep in touch with Ginnie Mae on our LinkedIn, Twitter and Facebook pages. About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|

| 10/24/2022 | | WASHINGTON, D.C. – Ginnie Mae President Alanna McCargo today announced policy changes to strengthen the mortgage sector by increasing issuer liquidity. Ginnie Mae is shortening the re-pooling seasoning requirement for re-performing loans from six months to three months and allowing issuers the option to pool re-performing loans into TBA eligible Ginnie Mae II Multi-Issuer Pools. Ginnie Mae will effectuate these policy changes no later than the end of Q1 2023 with a formal policy notice forthcoming. This change reverses several of the temporary pooling restrictions placed on re-performing loans introduced during the pandemic. See APM 20-07, dated June 29, 2020. The changes were announced at the Mortgage Bankers Association (MBA) Annual Conference where President McCargo delivered remarks focused on how Ginnie Mae is working with the mortgage industry to facilitate access to affordable mortgage credit for homeowners and renters across credit cycles. Her remarks touched on the importance of the Independent Mortgage Bank (IMB) sector, as well as Ginnie Mae’s support of the secondary mortgage market in a challenging interest rate environment. Ginnie Mae understands it is in the best interest of economically challenged borrowers, issuers, market-makers, and the investor community to ensure liquidity is reliably available. President McCargo re-emphasized the one-year extension of the implementation period for its Risk Based Capital (RBC) requirement published in its updated minimum financial requirements for IMBs in APM 22-11. The RBC requirement itself has not changed. Rather, the extended implementation period provides additional time for the mortgage industry to adapt to the new framework. “We are working through this cycle together,” said President McCargo. “I am committed to engaging with stakeholders to ensure a strong IMB industry that is able to continue supporting the many households facing significant affordable housing challenges.” Throughout the speech, President McCargo emphasized the importance of maintaining strong public and private sector partnerships. Stay in touch with Ginnie Mae on social media: Twitter, LinkedIn, Facebook

About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government. |

|

| 3/16/2022 | | WASHINGTON, DC – This week, Ginnie Mae President Alanna McCargo participated in her first public engagement since being confirmed at the National Association of Hispanic Real Estate Professionals (NAHREP) National Policy Conference in Washington. McCargo covered a range of topics and spoke about the equity order that President Biden and Secretary Fudge have centered federal agencies around. One theme she hit was her vision for Ginnie Mae to have leadership and staff who look like and understand the communities that we ultimately serve, and to make access to liquidity possible for smaller underserved community-based players. During her remarks, Alanna announced the appointment of Ginnie Mae’s first Latino Executive Vice President, Sam Valverde. Valverde was sworn in while McCargo was delivering her speech, and the news was met with an ovation by the NAHREP attendees. “We must have leaders that look like and understand the communities we ultimately serve,” McCargo said. Ginnie Mae is expanding its leadership team with the appointments of Valverde as Executive Vice President and Felecia Rotellini as Senior Advisor and Chief of Staff to the President. “Sam and Felecia are great complements to our executive leadership team and will be integral to the organization as we advance our strategic roadmap and strengthen our service to the nation’s diverse housing market,” said Ginnie Mae President Alanna McCargo. “I am thrilled to have their counsel and support as we work with all of our stakeholders to create broader and more equitable access to affordable homeownership and rental housing.” Valverde was most recently Supervisory Attorney Advisor at the Federal Housing Finance Agency (FHFA) in the Division of Conservatorship Oversight and Readiness. In that role, he led agency-wide projects intended to support greater access to mortgage credit and affordable rental opportunities for working families. He coordinated efforts to develop a post-conservatorship regulatory framework for the government-sponsored enterprises. Prior to his service at FHFA, Valverde served as a Counselor for Domestic Finance at the U.S. Treasury Department, focusing on consumer and housing finance issues. Rotellini brings to Ginnie Mae a deep background in corporate governance, regulation, compliance, and enforcement. She has bank supervisory and financial services expertise, as well as consumer protection experience in the subprime credit markets. As a former leader in financial services compliance and supervision, her experience in building diverse coalitions will help advance the public and stakeholder engagement strategy for Ginnie Mae. About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|

| 3/8/2022 | | WASHINGTON, D.C. – Approximately 191,000 homes and apartment units were financed by Ginnie Mae guaranteed mortgage-backed securities (MBS) in February 2022, indicating that the month’s issuance volume maintained the strong liquidity of the program and its value in meeting the financing needs of homeowners and rental property owners. Ginnie Mae’s MBS issuance volume for February 2022 was $53.01 billion. “The release of February MBS pool factors and prepayment activity show encouraging results,” said Office of Capital Markets Senior Vice President John Getchis. “Noticeably, borrower default-related prepayments occurring in Ginnie Mae’s securities continue their trend of monthly declines. February’s default-related prepayments consisted of less than 29,000 loans, the lowest level since April 2020, and well below the 48,708 average of the preceding 12-months. This trend improves the value proposition of Ginnie Mae MBS relative to other fixed-income and MBS investments.” A breakdown of February 2022 issuance of $53 billion includes $50.26 billion of Ginnie Mae II MBS and $2.75 billion of Ginnie Mae I MBS, which in turn includes approximately $2.59 billion of loans for multifamily housing. As of February 28, Ginnie Mae's total outstanding principal balance was $2.179 trillion, up from $2.168 trillion in January 2022 and up from $2.106 trillion in February 2021. For more information on monthly MBS issuance, UPB balance, REMIC monthly issuance and global market analysis visit Ginnie Mae Disclosure. About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|

| 2/15/2022 | | WASHINGTON, D.C. – Ginnie Mae today announced that it is adding a ”Green Status” field to its multifamily disclosure, giving investors information that supports their sustainable investing decisions and solutions. The new disclosure supports the goals outlined in the November 2021 Climate Action Plan from the Department of Housing and Urban Development and aligns with the Biden-Harris Administration’s government-wide effort to address climate change while creating economic opportunity. Ginnie Mae’s combined Multifamily Pool and Loan Disclosure Files for both daily/monthly new issuance and monthly portfolio data will have a new Green Status field (field L43) added to the loan section of the disclosure record. This third Ginnie Mae ESG/Green disclosure enhancement in less than one year is aimed at providing investors better Environmental, Social, Governance (ESG) information on which to base their portfolio decisions. “It’s great to see Ginnie Mae leading in a meaningful way on social and environmental investor disclosures and expanding on the great work on green multifamily financing that the Federal Housing Administration is actively engaged in,” said Ginnie Mae President, Alanna McCargo. “This new pool disclosure represents progress in our ongoing effort to enhance the value proposition of investing in Ginnie Mae mortgage-backed securities and make strides in the sustainable investing arena.” In 2021, Ginnie Mae took several ESG-related steps to enhance single-family MBS disclosure to give investors a view into pool level aggregate information about the social impact and extent to which loans are supporting low- and moderate-income areas and small balance loans, promoting housing affordability. Today’s announcement marks the first steps on multifamily MBS. In response to this announcement, HUD Deputy Secretary Adrianne Todman said, “In this decisive decade to combat climate change, Ginnie Mae’s actions today are an important component of HUD’s Climate Action Plan and a step forward in building a sustainable, resilient future.” The new securities disclosure allows investors to easily identify multifamily mortgage-backed securities whose collateral meets the requirements of FHA’s Multifamily “Green” Environmental Product Programs. This will assist investors in acquiring suitable investments to meet their ESG mandates and improve the liquidity of the securities in the secondary trading to other ESG investors. About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|

| 2/9/2022 | | WASHINGTON, D.C. – Ginnie Mae has published a LIBOR Index Transition Reference Guide (Guide) to assist stakeholders in preparing for the transition from the London Interbank Offered Rate (“LIBOR”) on the LIBOR index cessation date of June 30, 2023. The Guide will serve as an information resource for affected parties. “Ginnie Mae is committed to a smooth and efficient transition from LIBOR and the broad acceptance of a new and liquid alternative that meets the needs of investors and issuers in support of affordable mortgage finance,” said Ginnie Mae President Alanna McCargo. More details regarding Ginnie Mae’s transition from LIBOR can be found in the recently published 2021 Annual Report. About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|

| 2/8/2022 | | WASHINGTON, D.C. – Ginnie Mae reported today its January 2022 issuance volume, maintaining the strong liquidity of the program and its value in meeting the financing needs of homeowners and rental property owners. Approximately 230,000 homes and apartment units were financed by Ginnie Mae guaranteed MBS in January. Ginnie Mae mortgage-backed securities (MBS) issuance volume for January 2022 was $62.98 billion. “The Ginnie Mae MBS program began 2022 strong and stable, as issuers financed more than 230,000 homes through sale of MBS to investors around the world,” said Ginnie Mae President Alanna McCargo. “In January, Ginnie Mae also saw growing interest from issuers and investors for the Extended Term MBS, a new pooling option available to support homeowners exiting forbearance with more affordable loan modifications as they recover from the economic effects of the pandemic.” A breakdown of January 2022 issuance of nearly $63 billion includes $60.19 billion of Ginnie Mae II MBS and $2.79 billion of Ginnie Mae I MBS, which in turn includes approximately $2.63 billion of loans for multifamily housing. Ginnie Mae's total outstanding principal balance as of January 31 was $2.168 trillion, up from $2.149 trillion in the prior month, and up from $2.109 trillion in January 2021. For more information on monthly MBS issuance, UPB balance, REMIC monthly issuance and global market analysis visit Ginnie Mae Disclosure. About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|

| 1/21/2022 | | WASHINGTON, D.C. – Ginnie Mae announced today in All Participants Memorandum 22-01 (APM 22-01) that it is streamlining its documentation requirements for servicers participating in the Federal Housing Administration (FHA) Advanced Loan Modification (ALM) program. This step will eliminate the requirement for recordation and title insurance as described in more detail below. The new policy, effective for all ALMs, including those already in process or completed, supports the Biden-Harris Administration’s goal of assisting homeowners impacted by the pandemic on the road to economic recovery. This step helps create more efficiency so that servicers/issuers can help more homeowners transition from forbearance into a permanent modification.

In earlier actions developed to help homeowners transition from forbearance, Ginnie Mae in November expanded the use of digital signature for mortgage modifications, and in December guaranteed the first MBS pools comprised of extended term mortgages up to 480 months that increase affordability for qualifying homeowners.

“In order to fully stabilize the economy, servicers need as many tools as possible to help homeowners recover from the pandemic’s economic effects,” said Ginnie Mae President, Alanna McCargo. “This policy gives issuers clear guidance on how to move forward to help tens of thousands of FHA homeowners coming out of forbearance benefit from the FHA Advance Loan Modification.”

Under the streamlined policy, the issuer is required to provide the following documentation to the Document Custodian: - Original fully executed Loan Modification Agreement, signed by all borrowers, and in recordable form.

2

- If the Issuer determines recordation is necessary to maintain an enforceable first lien position, or if the loan modification agreement contains assignments of leases or rents provisions, the modification must be recorded for final certification.

- If the modification is recorded, the Issuer must also comply with the title insurance requirements in Chapter 24, Part 2, §A(2), as well as obtain the necessary title policy or endorsement, and subordination(s) as indicated on title.

- The modified loan file must clearly identify for the document custodian that it is an ALM.

Document custodians will not be required to verify that the ALM is recorded, unless the loan modification agreement contains provisions for assignment of leases or rents, or title insurance is present. However, if the ALM loan modification agreement is recorded, title insurance that meets the requirements of Chapter 24, Section 2 is required.

More details regarding the new streamlined policy can be found in APM 22-01 and in the relevant sections of the Ginnie Mae MBS guide.

About Ginnie Mae

Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|

| 1/11/2022 | | WASHINGTON, D.C. – Ginnie Mae today released its latest Capital Markets Live podcast, which examines the relationship between the strength of the Federal Housing Administration’s Mutual Mortgage Insurance (MMI) fund and Ginnie Mae Mortgage Backed Securities (MBS) based on the latest annual report released by FHA in November 2021. Ginnie Mae Managing Director of International Markets, Alven Lam is joined on the podcast by Stephen Abrahams, Senior Managing Director and Head of Investment Strategy at Amherst Pierpont Securities. The Ginnie Mae Capital Markets Live podcast can be heard here. The full report on the FHA MMI fund can be found here. About Ginnie Mae Ginnie Mae is a wholly owned government corporation that attracts global capital into the housing finance system to support homeownership for veterans and millions of homeowners throughout the country. Ginnie Mae MBS programs directly support housing finance programs administered by the Federal Housing Administration, the Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing and the Department of Agriculture Rural Housing Service. Ginnie Mae is the only MBS to carry the explicit full faith and credit of the United States government.

|

|